by trueimpactdigital | Oct 9, 2024 | Loans

Banks accept a wide range of collateral for secured loans, depending on the type of loan, the bank’s policies, and the borrower’s financial situation. Here’s a list of common types of collateral accepted by banks: 1. Real Estate Property Residential...

by trueimpactdigital | Oct 8, 2024 | Loans

How to Refinance Existing Personal Loans Refinancing a personal loan involves replacing your current loan with a new one, typically with better terms, such as a lower interest rate, reduced monthly payments, or an extended repayment period. Refinancing can help...

by trueimpactdigital | Oct 8, 2024 | Loans

Distinguishing between genuine loan apps and scam apps on the Google Play Store is critical to protect yourself from financial fraud, identity theft, and high-interest predatory loans. Here are key steps and precautions you can take to identify a legitimate loan app...

by trueimpactdigital | Oct 7, 2024 | Loans

How to Refinance an Existing Construction Loan Refinancing a construction loan can provide more favorable loan terms, such as lower interest rates, extended repayment periods, or converting it into a traditional mortgage. Refinancing allows borrowers to secure better...

by trueimpactdigital | Oct 7, 2024 | Loans

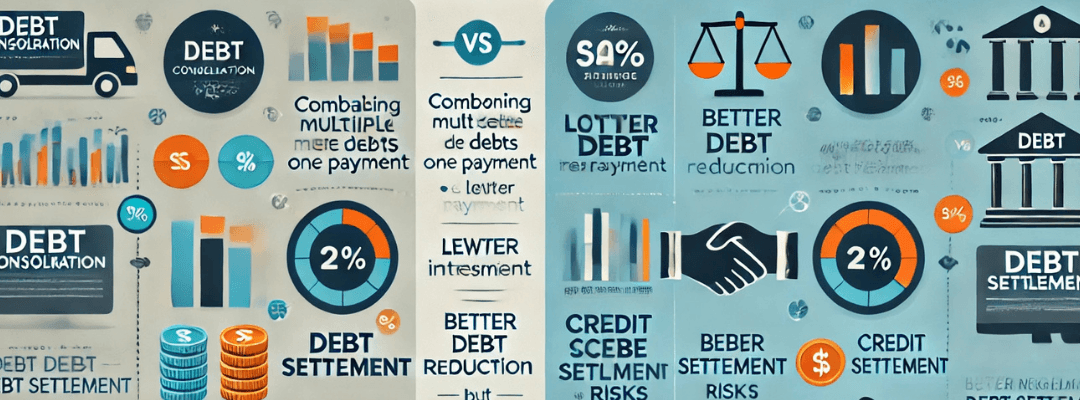

Debt consolidation and debt settlement are two different strategies used by individuals to manage and reduce their debt. Each approach has its unique advantages, disadvantages, and implications for your credit score and financial health. Here’s a detailed...

by trueimpactdigital | Oct 6, 2024 | Loans

Foreclosure of a personal loan refers to paying off the entire outstanding loan amount before the original loan tenure ends. While this can save you interest costs, many lenders impose penalties for early repayment. These penalties can range from 2% to 5% of the...